Mechanical Breakdown Insurance

Looking for Mechanical Breakdown Insurance in NZ? Autosure offers comprehensive cover that may help pay for repairs when things go wrong, so you can get back on the road fast. Cars today are complex and have so many mechanical and electrical components, so we’ve designed our policies to help protect you and your budget against the cost of certain unexpected breakdowns.

What is Mechanical Breakdown Insurance in NZ?

Mechanical Breakdown Insurance (MBI) provides financial protection if your car has a breakdown, as outlined in our policy terms and conditions. In New Zealand, having the right cover means peace of mind and fewer financial surprises after a breakdown.

We’re here to help with unexpected repair bills, to get your car fixed and you back on the road again.

Autosure’s mechanical breakdown insurance is underwritten by Autosure Insurance Limited, giving you confidence your policy is backed by one of NZ’s leading MBI insurers.

Key benefits of Autosure Smart Cover & Extreme Plus Mechanical Breakdown Insurance

- Comprehensive parts and labour cover

- Towing and 24/7 AA roadside assistance

- Car repatriation, accommodation & travel

- Optional cover for additional components and consumable items

- Protects petrol and diesel cars, EVs and hybrids

Important information

- Cover periods available: 1 – 4 years.

- Your responsibilities: Vehicle servicing and maintenance.

- Excess: You can reduce your premium by increasing your excess.

- Exclusions: See the policy wording What You Are Not Insured For section.

- Cancellations: Cancel within the first 15 days for a full refund, if you haven’t had a claim.

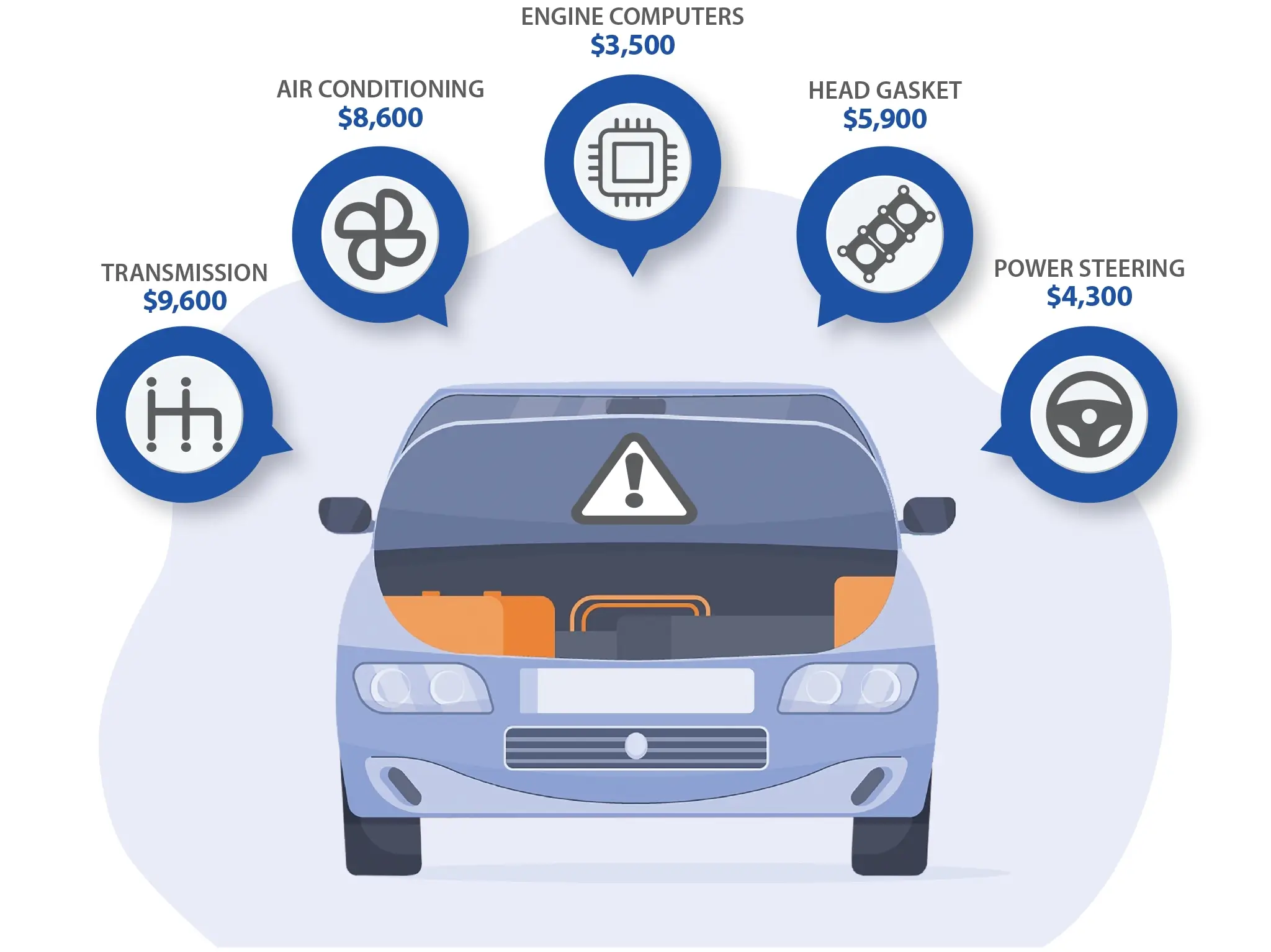

Images and amounts are for illustrative purposes only. Underwriting criteria apply. Repair costs (based on 2023/4 claims) vary for make/model and not all components are covered by all policies.

SMART COVER

EXTREME PLUS

Max individual claim*

$5,000

$10,000

Parts & labour cover

Yes

Yes

Additional components

N/A

Yes

Consumable items

N/A

$750

Car repatriation

$250

$500

Accommodation & travel

$500

$1,500

* The total of all claims is limited to the vehicle’s market value.

This is a summary only. See the policy wording for full terms, conditions, exclusions, limits and benefits. This is not financial advice.

Why choose Autosure for mechanical breakdown insurance?

Autosure has been helping New Zealanders protect their cars and their savings from the cost of unexpected breakdowns for decades. As a leading insurance company in the mechanical breakdown insurance industry, we strive to bring our customers the best products with the best benefits, so you can have confidence for the road ahead.

Over the holidays we had a client from Auckland whose car suffered a sudden failure while they were on holiday in the Bay Of Islands. Fortunately, the couple had Autosure Mechanical Breakdown Insurance. That meant their car was towed to the nearest approved repairer in Whangarei, where it was quickly fixed. And in the meantime, Autosure covered the costs of a rental car, so they could continue with their holiday before heading home safely. Towing, repairs and rental car expenses add up – imagine if they’d had to add an unbudgeted $1,700 to their holiday costs!

Policy documents

You can download the full policy wording below to understand exactly what’s covered and excluded:

These are the current versions of those policy wordings.

You can also view Assist & Assist Plus, and Advantage & Advantage Plus policy wordings.

Please contact us if you would like copies of previous policy documents or schedules, or copies of policy wordings for other brands that Autosure underwrite.

FAQs about mechanical breakdown insurance NZ

Mechanical breakdown insurance cover generally includes the reasonable cost to repair the failure of certain mechanical or electrical parts that is not a result of general wear and tear. It provides protection for unexpected repair costs on components like the engine, transmission, or other critical systems, and can include towing, roadside assistance, car repatriation, accommodation and car hire allowances or travel costs, up to certain levels if your claim is accepted. Mechanical breakdown insurance is different from comprehensive car insurance, which is for things like accidents and theft. Comprehensive car insurance does not provide cover for breakdowns. Limits, conditions and exclusions apply, so always check the policy wording.

Yes, mechanical breakdown insurance (MBI) can be very valuable if you own a used car, especially if it has high mileage or is out of manufacturer warranty. It can save money on costly repairs like transmission or engine issues.

In New Zealand, MBI may cover major mechanical and electrical failures that aren’t included in standard car insurance. Repairs like transmission issues, ECU failures, or engine faults can cost thousands of dollars, and MBI may help reduce the financial impact by covering these costs. It’s important to find a policy that suits your car and budget.

In New Zealand, the cost of mechanical breakdown insurance (MBI) varies depending on several factors:

- Make and model of your vehicle

- Age and mileage

- Length of cover (usually 1 to 4 years)

- Level of excess you choose

- Type of vehicle (petrol, diesel, hybrid, or electric)

Note: The premium for the full length of cover must be paid in a single payment.

The potential cost of breakdown repairs is worth considering when looking at the cost of MBI.

Mechanical breakdown insurance (MBI) does not cover:

- Accidental damage (e.g. collisions, fire, theft)

- Wear and tear (e.g. tyres, brake pads, wiper blades)

- Routine maintenance (e.g. oil changes, filters, spark plugs)

- Cosmetic damage (e.g. paint, upholstery, trim)

- Pre-existing faults or issues present before the policy started

- Modifications or aftermarket parts not approved by us

- Negligence or misuse (e.g. racing, off-roading, lack of servicing)

- Carrying passengers for hire or reward (e.g. taxi, Uber, ride-share services)

- Transporting goods for payment (e.g. courier or delivery services)

This is a summary only. Always check your policy wording for specific exclusions, as coverage can vary between providers. Autosure MBI covers a wide range of components, but limits, conditions and exclusions apply, so always check the policy wording.

Yes, you can get mechanical breakdown insurance (MBI) for a used car in New Zealand. MBI is designed to cover the cost of unexpected mechanical or electrical failures, which are more common in older vehicles or those no longer under factory warranty.

Underwriting criteria apply, but generally Autosure can provide policies for petrol, diesel, hybrid and electric cars up to 20 years old, that have mileage of less than 200,000km. Always check the policy wording for exclusions and claim limits.

Used cars can be more prone to breakdowns. MBI can help you avoid large, unexpected repair bills and it could increase resale value if the policy is transferable.

Yes, regular servicing is required to keep your Autosure Mechanical Breakdown Insurance policy valid. It is your responsibility, at your cost, to maintain your vehicle in good repair and take all reasonable steps to prevent any damage.

Regardless of the servicing requirements of your vehicle’s manufacturer, you must have your vehicle serviced at whichever of these intervals occurs first, from the start date of the period of insurance:

- Petrol and electric vehicles: 15,000km or 12 months

- Petrol turbo, supercharged and diesel vehicles: 10,000km or 12 months

You must meet the cost of your vehicle servicing and make sure that your vehicle service is recorded. The servicing of your vehicle must be carried out by a suitably qualified service centre. Please see the policy wording for details of what must be checked, replaced or attended to, if applicable, necessary or specified by your vehicle’s manufacturer, as part of the service. Failure to meet these requirements can invalidate your policy, meaning claims may be declined.

It’s a good idea to keep all your service records and receipts, as they may be needed when making a claim.

No, regular car insurance (including comprehensive policies) does not cover mechanical failure. In New Zealand, comprehensive car insurance typically covers accidental damage, theft and fire, natural disasters and third-party property damage. However, it excludes coverage for mechanical breakdowns (e.g. engine or transmission failure) or electrical faults. To protect against unexpected mechanical or electrical failures, many Kiwi drivers choose to take out mechanical breakdown insurance (MBI).

Mechanical breakdown insurance (MBI) covers the cost of repairs or replacement of selected major vehicle components that fail due to mechanical or electrical faults – not due to accidents, wear and tear or lack of maintenance. It typically includes:

- Engine and transmission

- Electrical systems

- Steering and suspension

- Fuel systems

- Cooling systems

- Braking systems

- Drive axles and differential

MBI is designed to protect you from unexpected repair bills once your manufacturer’s warranty expires. Many policies, including Autosure’s include roadside assistance and other useful additional benefits. Coverage varies by provider, so it’s important to check the specific terms, exclusions, and claim process.

Get a quote

Ready to protect your car with mechanical breakdown insurance? Get a quote today and discover why thousands of drivers choose Autosure for reliable, comprehensive cover.

These policies are underwritten by Autosure Insurance Limited. Find out more about Autosure’s financial strength rating.

Autosure Insurance Limited is a member of the Financial Services Federation. Find out about their Responsible Credit-Related Insurance Code.